Investment Management for Nonprofit Organizations

Today, nonprofit organizations face increasing and overwhelming challenges. Rising costs, cuts in government funding, increased competition for donations, volatile markets, low interest rates, capital market complexities, budgetary pressures and fiduciary liability concerns have led many institutions to outsource their investment management and oversight. Merchants Bank can efficiently and effectively assist nonprofit organizations navigate these challenges.

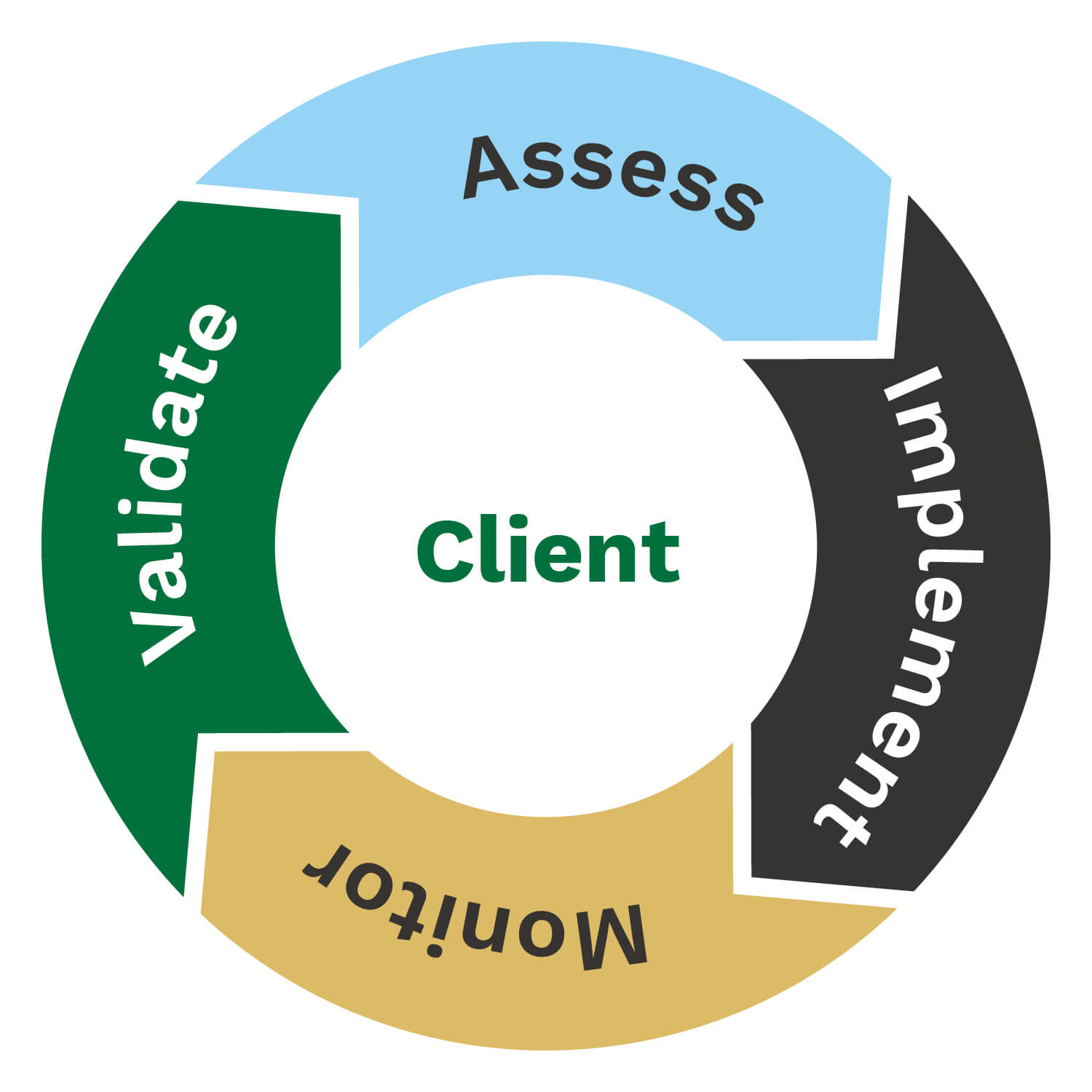

After first focusing on, reviewing, and fine-tuning your Investment Policy Statement, we provide best-in-class investment management services for our nonprofit clients. We work to achieve your organization’s investment goals in line with your investment policies while maintaining cash flow needs.

We apply our Investment Approach, Investment Perspective and Investment Process when working with:

- Academic and educational institutions

- Charities and service institutions

- Associations

- Faith-based and religious institutions

- Healthcare institutions

- Foundations

- Endowments